Springfield, Mo. – According to the National Foundation for Credit Counseling™ (NFCC) recent online poll, when asked what they would be most embarrassed to admit, the highest number of respondents, 37 percent, indicated it was their credit card debt.

People were given five categories from which to choose. In addition to credit card debt, the options included age, weight, bank balance, credit score or none. Coming in a strong second, 30 percent of respondents indicated they would be embarrassed to admit their credit score. Since debt and credit scores can be related, it is not surprising that these two concerns earned the unenviable top two spots in the poll.

The following illustrates the relationship between credit card debt and credit scores:

- Excessive credit card debt should be seen as a warning sign that a person is in the financial danger zone. Although credit cards may appear to be the solution to a financial shortfall, charging beyond what can be repaid each month can quickly get out of control. Debts that cannot be responsibly managed may lead to late payments resulting in fees being added onto the balance and can sometimes take years to repay. Such activity is likely to negatively impact a person’s credit report and potentially result in a lower credit score.

- Typically one of the highest weighted elements of a credit scoring model is the credit utilization ratio which considers how much a person owes versus his or her available line of credit. Although lenders each have their own criteria for evaluating credit worthiness, it is smart to not utilize more than 30 percent of available credit.

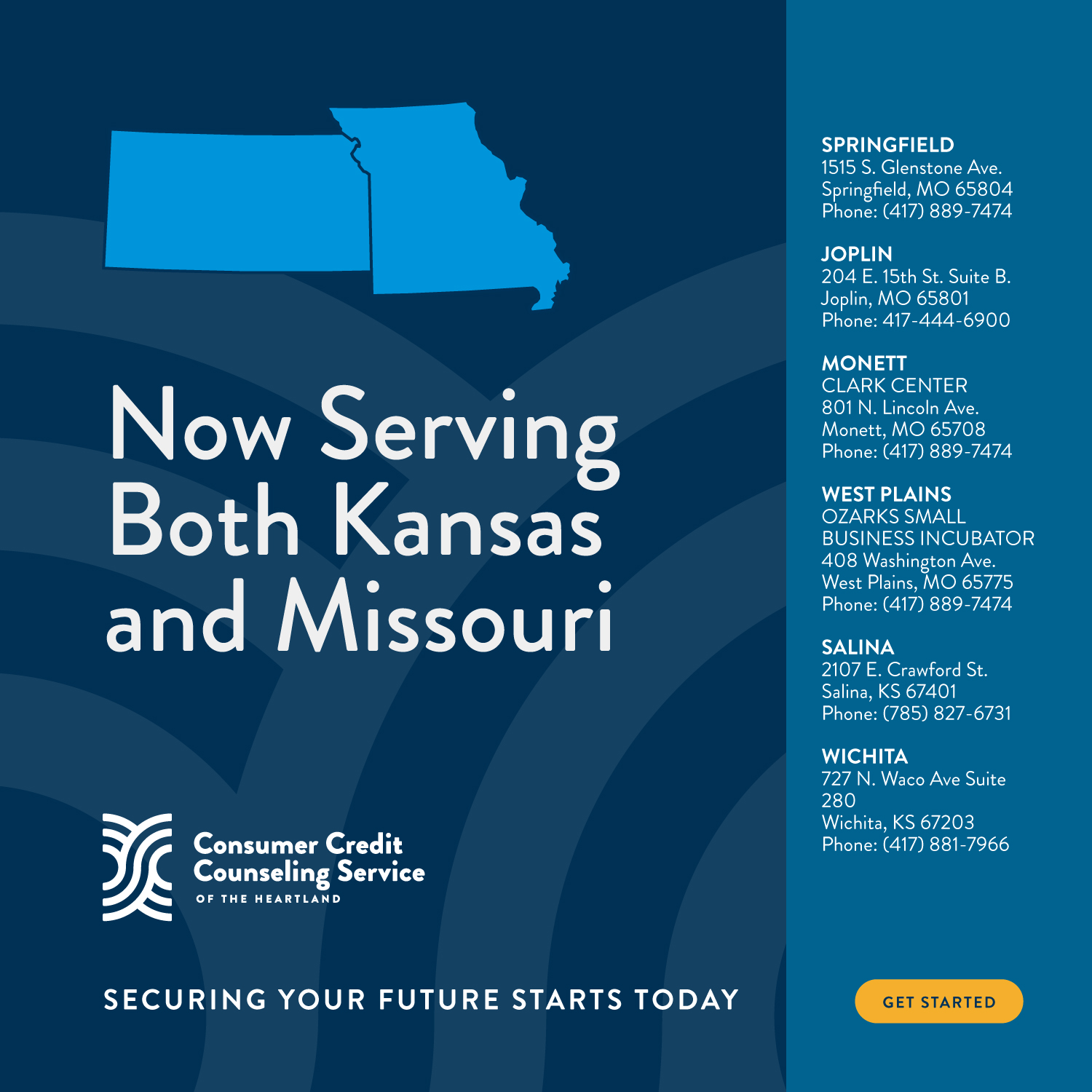

“Since consumers revealed that the two facts they’d be most embarrassed to admit are related to credit, it is obvious that they are not comfortable with how they are currently managing their money,” said Joe Stokes, CEO of Consumer Credit Counseling Service of the Heartland. “The good news is that there are solutions available for those who want to take charge of their financial future. Since April is Financial Literacy Month, now is the ideal time for people to address their financial concerns.”

The NFCC’s Sharpen Your Financial Focus™ program has met the needs of tens of thousands of consumers since it launched six short months ago. The program combines three of the NFCC member agency’s most popular services including a one-on-one financial review with an NFCC Certified Financial Professional, the online financial self-assessment tool MyMoneyCheckUp™, and a targeted education session on the consumer’s topic of choice.

For help overcoming your most embarrassing financial moments, reach out to CCCS of the Heartland and inquire about the three-step Sharpen Your Financial Focus program. To speak with an NFCC Certified Financial Professional, dial 417-889-747 4 or visit www.cccsoftheheartland.org.

The NFCC March poll question and results are as follows:

I’d be most embarrassed to admit my…

- Age = 1%

- Weight =12%

- Credit card debt = 37%

- Bank balance =10%

- Credit Score = 30%

- None of the above = 9%

Note: The NFCC’s March Financial Literacy Opinion Index was conducted via the homepage of the NFCC website (www.DebtAdvice.org) form March 1-31, 2014, and was answered by 2,168 individuals.

Consumer Credit Counseling Service of the Heartland is a local, not-for-profit organization that has been providing financial education to the southwest Missouri area since 1969. Policies and procedures are established by a local board of directors and it is fully-accredited as a credit counseling agency with NFCC certified financial professionals. Visit us on Facebook www.facebook.com/CCCSoftheOzarks or our website: www.cccsoftheheartland.org.